As a new Amplify member, the fastest way to move money to your account and claim the benefits of fee-free banking is through your direct deposits. We make it easy to switch your direct deposits from your old bank to Amplify, and even provide you with a direct deposit from if needed. In this article, we'll walk you through the steps of switching or setting up your direct deposit at Amplify.

Key Takeaways:

- Amplify now offers early direct deposit to members. Learn more here.

- You can set up a direct deposit in online banking using the Amplify routing number (314977227) and your individual account number.

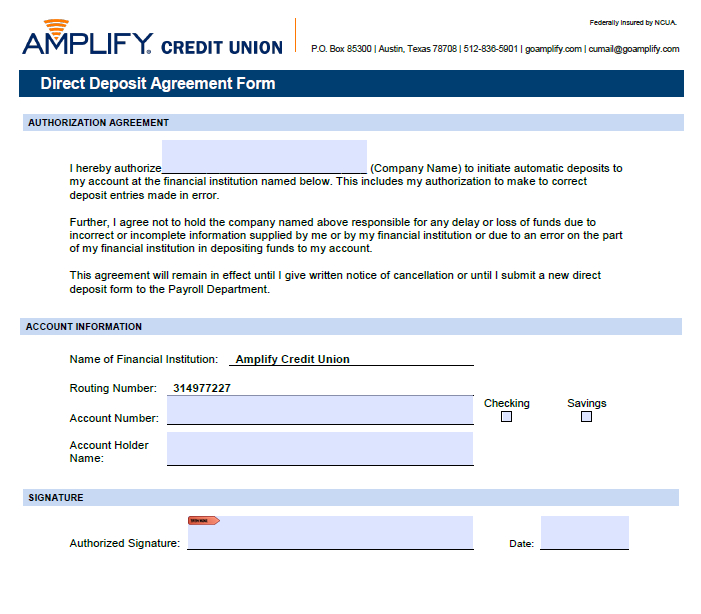

- If your employer does not offer direct deposit, complete the Amplify Credit Union Direct Deposit Agreement Form and submit it to your current human resources or people team.

How do I set up a direct deposit?

Check with your employer to see if they have a custom direct deposit form for you to complete. You will need to enter the following information:

- Your name.

- Your Amplify account number. This can be found in online banking or on your statements.

- Amplify's routing number. This number is 314977227.

Please note that these deposits are processed using the Automated Clearing House (ACH) network, which does not process on weekends or holidays. To learn more about your company's payroll schedule, talk to your human resources department about their operating hours and holidays.

Can I get a direct deposit from Amplify?

In the rare case that your employer does not provide the necessary paperwork, you can supply your paperwork using the Amplify Credit Union Direct Deposit Agreement Form. We have provided our institution name and routing number in the attached PDF. Click on the image below to download the form.

Are direct deposits safe?

Direct deposits are an incredibly safe way to receive payments. In the unlikely event that a check is misplaced, whoever locates that check would have access to your deposit information. This can include your name, mailing address, and even employee-specific details noted on the payment (such as your employee identification number). Furthermore, direct deposits provide both the sender and the recipient with a record of the transaction. This removes the added uncertainty of sending a check through the mail.

Are direct deposits fast?

Mailed payments may take several days to reach your address of record. If there are errors or discrepancies with the payment - if the check is written in the wrong amount or to the wrong individual - what should be a simple deposit can take a week or even more to process. This can also ensure that your paycheck is deposited on a consistent day and date of each month, making it easier for you to prepare your monthly budget.

Where can I see incoming direct deposits?

Once we receive notification of an incoming direct deposit, the transaction will appear as a pending credit at the top of your account’s transaction history viewable in online banking. Pending deposits will not be treated as available funds until they are posted to your account. You can view the scheduled posting date - which is determined by your employer or payer - by clicking on that line item in the transaction history field. Please note that the amount and date can be modified by the sender while pending.

Can direct deposits be split across multiple accounts?

This depends on the payment options made available by your employer. Contact your current payroll team to learn more about your current direct deposit options.

Do social security benefits require direct deposits?

On March 1, 2013, a new law was passed that requires all social security or supplemental security benefits to be handled via direct deposits. For more information on Social Security direct deposits, visit the U.S. Department of Treasury Go Direct website or call the helpline at 1-800-333-1795.