Many of our members keep their primary checking and savings accounts with Amplify Credit Union. Still, even these members sometimes need to transfer money to or from a different account. In this article, we will explain how you can add an external account to your online banking setup. We will then show how you can quickly transfer funds between Amplify and other accounts, such as banks, credit unions, or even third-party businesses.

Key Takeaways:

- For external transfers within online banking, you must be an owner of the external account you wish to connect.

- To learn how to transfer money to another Amplify member, please visit our Transferring Money Between Members article.

How do I transfer money to an external account?

It is very easy for members to set up transfers between Amplify and external accounts. To begin, select one of two verification options.

Instant Verification

To make external transfers as painless as possible for our members, we recently partnered with Plaid, a financial services company that specializes in instant account authentication. When selecting an authentication option for an external account, you will be asked to provide your credentials in the Plaid screen.

- Click the Profile & Settings dropdown in the online banking menu.

- Click Manage External Accounts.

- Click the Link via Instant Verification button and follow the instructions.

Once confirmed, you will immediately see this account listed as an external account in the transfer options.

Micro Deposits

If you are unable to authenticate your external account using Plaid, you will also have the option of using micro-deposits to verify your account. Micro-deposits often take 2-3 days to authenticate and can be initiated in two simple steps.

- Click the Profile & Settings dropdown in the online banking menu.

- Click Manage External Accounts.

- Click the Link via Micro-Deposits button and follow the listed instructions.

Once complete, you will be free to transfer money between Amplify and your external accounts. Please note that you must be an owner of the external account you wish to connect.

Step One: Add an External Account

To transfer funds to or from an external account, you will need to connect your Amplify account with an external account at another financial institution.

- Click the Profile & Settings dropdown in the online banking menu.

- Click Manage External Accounts.

- Click the Link via Micro-Deposits button and follow the listed instructions.

Next, you will need to input the following information about the account you would like to add:

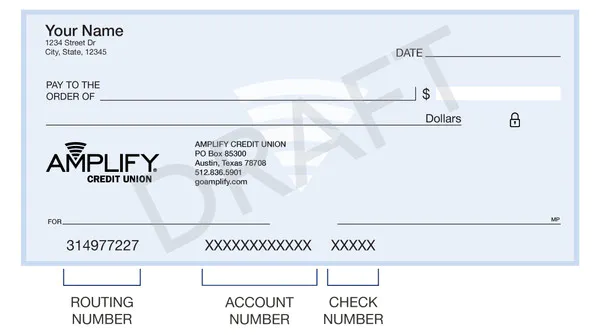

- Your institution's routing number.

- Your account number (maximum length of 17 digits).

- Your account type (checking or savings).

You will likely find the routing and account number on your checks or in the institution's online banking platform. Visit the Routing Number and Account Number section of our FAQ to learn more.

Once you enter this information, Amplify will generate two "micro-deposits" and send them to your external account. Micro-deposits are random transactions in amounts of less than $1.00. These transactions typically occur within five business days. Please note that these transactions may "time out" after ten business days of no action, requiring you to start the verification process over again.

If the transactions do not appear in your account within the specified timeframe, contact the other financial institution. Not all banks and credit unions use the same routing number for all accounts. Talk to their customer service department if you have questions about the accuracy of your account information. Only domestic (U.S.) banks are allowed.

Step Two: Verify the Deposit Amounts

Next you will need to verify these amounts within Online Banking before you can begin transferring money to or from the external account. Once you receive these deposits in your external account, return to the Manage External Accounts screen under the Profile & Settings dropdown in online banking. This is where you will select the account you wish to verify.

Select the account you want to verify and enter the amounts of the two deposits made into your external account. These amounts must be verified in the order they were received. Click the Submit button to complete the verification process. You have up to 10 days to complete this verification process before the deposits expire. If the deposits do expire, repeat the first step.

Once you verify the amounts, you will have successfully added an External Account. This account will be listed in the drop-down menu of available accounts and will now be an eligible account to transfer to and from.

Step Three: Transfer Between Accounts

Once you have added an external account, you can now transfer money between your Amplify accounts and the external financial institution.

- Open the Transactions dropdown in the online banking menu.

- Click Make a Transfer.

Now you will be able to select your external account when transferring funds to or from Amplify.

How long does it take for funds to transfer?

Amplify accounts will be debited for these funds within a single business day, making it easier for members to manage their account balances and outgoing transfers. Please note that the speed with which these funds are posted to the target account - such as an external financial institution - will depend on their processing time as well, so you should plan ahead to ensure any time-sensitive payments are made in full.

If you are one of the many Americans who holds accounts at more than one financial institution, you may sometimes need to transfer funds from Amplify to your external bank account. When you initiate this transfer in your Amplify checking account, these funds will be withdrawn from your account within a single business day.

This will allow you to better manage upcoming expenses - such as bills or subscription services - around your biweekly paychecks. However, the funds may not post to your external account for another business day (or more), depending on the financial institution.