One of the most significant benefits of online banking at Amplify Credit Union is our mobile check deposit feature. Mobile check deposits have become the industry standard. Between work and family schedules, it can be challenging to find time to make it to an Amplify branch location. Nobody should delay their busy schedule just to add money to their bank account.

In this section, we will discuss some of the mobile check deposit best practices. We will also provide you with a few troubleshooting options if you find yourself struggling to complete your deposit.

Key Takeaways:

- Endorse the check and write "For Amplify CU Mobile Deposit Only" on the signature box.

- Photograph your check in a well-lit room.

How do I enroll in mobile check deposit?

To get started using our mobile check deposit feature, you will first need to enroll in the service using the Mobile Dep Enroll link. This can be located under Transactions in the online banking sidebar from either your desktop or mobile device. Once enrolled, you will be able to use the Deposit Check option in the Transactions menu.

How do I prepare my check for mobile deposit?

Just as you would with a paper check, you will be required to endorse your check. This is done by signing the designated area on the back of your check. We also strongly encourage our members to include the following information in the signature box:

- "For Amplify CU Mobile Deposit Only."

- Your Amplify Credit Union account number.

You can also check the box identifying this as a mobile deposit (if available). Failure to provide a proper endorsement may result in delayed processing or reversal of your deposit.

How do I submit a mobile deposit?

First, you will want to verify that your phone's camera meets the technical requirements for mobile check deposit. You must have an auto-focus camera with at least 5 megapixels. Most modern cameras meet this standard, including the rear cameras on the iPhone 11 (12 MP), the Google Pixel 3A (12.2 MP), and the Samsung Galaxy S10 (16 MP). If you are not sure of the camera quality on your phone, check reviews of your phone for the camera specifications.

Otherwise, here are four things to keep in mind when taking photos of your checks.

- Take your photo in a well-lit room.

- Place your check against a solid dark background.

- Align your check with the boxes on the screen.

- Avoid brighter ink colors when signing your check (black ink is best).

What are common mobile deposit mistakes?

While mobile check deposits can be a fast and painless process, there are a few common photograph mistakes that can require members to submit checks more than once. Here are a few common sticking points to avoid with your first - or next - mobile check deposit.

- Cut corner(s) or side(s). Checks that are not visible in their entirety can cause issues. To keep your full check in the frame, hold the phone and take the picture in landscape mode. Use the viewfinder box to photograph the full check with all four corners visible.

- Cropping/Complex Background. Sometimes a check will blend into the background or still be attached to the stub. Counter this by placing your check on a dark, monochrome background - no patterns, please! - and remove other items from the picture.

- Out of Focus/Low Contrast/Small Image. In some rare cases, the image is blurry, making data extraction and even detection of the check impossible. Hold the camera steady and slowly zoom in and out until the system recognizes the boundaries of the check.

What type of notifications will I receive?

After submitting a mobile deposit, you will receive a series of confirmations from Amplify that your deposit has been received, approved, and/or denied. Below are short descriptions of the information you can find in each email.

- Subject Line: "Amplify CU - Mobile Deposit Received"

- This email confirms your deposit has been submitted and received by Amplify. You should receive this email immediately after submitting your mobile deposit.

- Subject Line: "Amplify CU - Mobile Deposit Approved"

- This email confirms that your deposit has been approved. Please note that your deposit may still be subject to holds.

- Subject Line: "Amplify CU - Mobile Deposit Rejected"

- This email will inform you that your mobile deposit has been rejected. You can see the cause of the rejection in the Rejected Reason field and contact our team at (512) 836-5901 if you have any questions.

When will my funds be available?

Deposit funds added with the Amplify Credit Union app follow the same rules and processes as checks deposited in our branches. You can check the funds availability disclosure in online banking to learn more about limits and hold periods.

Because some funds are available immediately, it is possible for Amplify to reject the mobile deposit after the credit has been placed in the account. When this happens, you will receive two communications related to the rejection:

- A mobile deposit rejection notification that includes the rejection reason.

- A deposit reversal in your transactions history, with Reverse Mobile Deposit listed as the debited account.

Please note that some checks may fall above the existing threshold for mobile deposits. If your mobile deposit attempt exceeds our limits, please refer to our existing list of Amplify Credit Union branches for information on where deposit your check.

How do I view a copy of my deposit?

Once a mobile deposit has been submitted, you will be able to see these items in online banking for up to six months. The image of the deposit will also be available for six months.

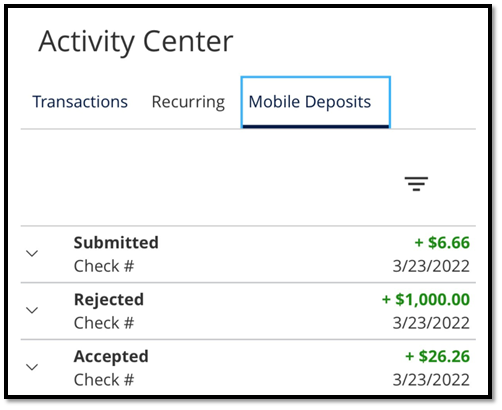

To view your previous deposits, log into online banking on your desktop or mobile device and follow the steps outline below.

- Click on the Transactions dropdown menu in the online banking sidebar.

- Click Activity Center.

- Select Mobile Deposits from the transaction types.

What do I do with my check after depositing it?

Although rare, there are instances where we may need to review the physical copy of the check to complete your deposit. This is especially true when making high-dollar deposits into your accounts. As a safety measure, we recommend storing your deposited check in a secure place for 3-7 business days (and then destroying it after the deposit is processed).

What if I encounter an issue with mobile deposit?

If you are logged into mobile or tablet banking and do not see “Deposit Check” under the Transactions screen, this could be caused by a few factors.

- You have not yet enrolled in Mobile Check Deposit.

- Your device may not support Mobile Check Deposit.

- Your device may be using an outdated operating system and/or an obsolete version of the Amplify CU app.

If your problems with this feature persist, please contact our support team at (512) 836-5901 or toll-free at 1 (800) 237-5087. You can also reach an Amplify representative within online banking using our live chat portal.